WE HEARD ALL THE HYPE. So, what happened? Why hasn't the mobile commerce revolution ignited in this country?

A number of factors are to blame, and ironically, our own advances have held us back. Our country's superior land-based telecommunications infrastructure is probably the biggest culprit. Of course, a lack of wireless security standards, a lack of reliability in cellular reception and slow browsing capabilities certainly contribute to the U.S.'s slower up-take of the wireless Internet. Europe and Asia are much further ahead.

However, all is not despair. There are opportunities for ISOs to cash in on the wireless market - today. According to The Meta Group, there are more than 32 million mobile workers in the U.S., across a variety of industries.

So what is the secret? It's simple. Resell terminals with wireless capability.

Many workers need to accept payments for goods or services, either in an on-the-move environment (such as food delivery, or field sales representatives), or in a temporary location (such as trade shows). Further, wireless terminals extend beyond the mobile workforce, enabling the retail sales clerk to accept payment anywhere.

In order to leverage this market and successfully turn the wireless opportunity into revenue, you need to understand the primary features of wireless terminals, what the benefits are to your potential customers and who these potential customers are.

Key Features

A wireless terminal connects to a merchant's payment processor via a wireless modem, instead of by phone line or cable. This modem may be built into the terminal or attached to or inserted into the terminal.

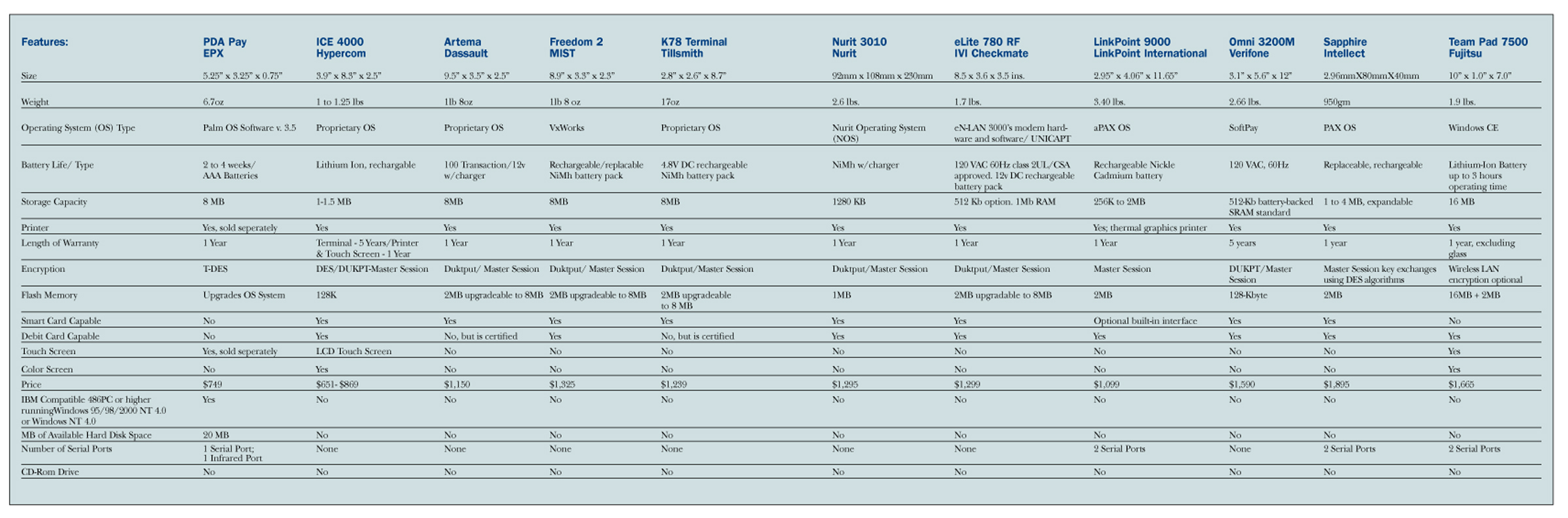

Wireless terminals may process a variety of electronic payment types, including credit, debit, smart card and electronic check payments - in real time. The types of payments that may be transmitted vary for each model, so once you assess the payment types the merchant needs, you should select a wireless terminal model accordingly.

The terminal's operating system is also an important feature. Some offer a proprietary operating system, whereas others offer an open operating system, such as Windows CE or Palm OS. The advantage to an open operating system is that it usually includes PDA (Personal Digital Assistant) functionality. The open operating system also offers merchants the ability to develop other applications for the same device.

The wireless service provider will also vary, depending on the wireless terminal model. When selecting a wireless terminal, it is important to find out the fees charged by the wireless service provider, as well as the geographical areas the provider covers. Inevitably with a mobile worker, there will be a sale that is made in an area without wireless reception. Therefore, for this type of merchant, it would be wise to determine if the terminal will store the captured card information when there isn't receptivity, so that the merchant can still process the payment electronically once wireless receptivity is regained.

Benefits to the Merchant

To market wireless payment terminals, you'll need to communicate their value to potential clients. While the mobility of the wireless terminals is an underlying feature that can be sold to many types of businesses, each market segment will realize varying benefits.

On-the-Move

Merchants on-the-move may include food delivery, home service companies (such as HVAC, repair and cleaning services), field sales representatives (such as Avon or PartyLite sales) and transportation services (such as limo and taxi services). In the past, many of these companies have either been unable to accept credit card payments or have accepted card payments manually and therefore, not in real time.

A wireless terminal will enable on-the-move merchants to offer their customers a secure, convenient payment option with increased transaction speed - which will inevitably increase the merchant's sales.

Direct benefits to the merchant include card-present discount rates, reduced interchange costs, fewer declined transactions and reduced fraud. Moreover, wireless card processing increases a merchant's efficiency since he no longer needs to spend time writing cardholder information down, calling in for voice authorizations or key-entering transaction information. Finally, wireless terminals can reduce the authorization response time, ultimately increasing the number of purchases a merchant can accept within a given time-period.

Temporary "Storefront"

Merchants who make sales at sporting events, tradeshows, craft fairs, art shows and so on are grouped in the temporary "storefront" category, because they usually set up shop for a limited amount of time, before moving to the next event. The mobility of the units enable the representatives to take payments from any location, eliminating a crowd in one particular station of their sales area, which may discourage other visitors from stopping by.

Non-mobile merchants

The opportunity to sell wireless terminals does not stop with merchants who are mobile. Wireless terminals also have value in the everyday retail and food service environments.

Many of the benefits that apply to mobile merchants also apply to retail merchants, including: reduced phone line use, opportunity for all sales representatives to carry the terminal, increased authorization response time and reduced lines at the counter.

Wireless terminals obviously have some very tangible applications to today's business needs. Once you understand the key features and benefits, as well as the targeted merchants, you can turn this wireless opportunity into revenue.